Sales tax allocations fall for second-straight month in Gonzales County

Sales tax allocations for October 2023 were down from last year’s amounts for all four municipalities in Gonzales County — the second straight month Gonzales County saw a decrease in its sales tax coffers.

The downward trend has resulted in a leveling off of funds which cities like Gonzales depend on to make their yearly budgets and could be indicative of a hesitancy on the part of buyers to spend money in an unsure economic environment.

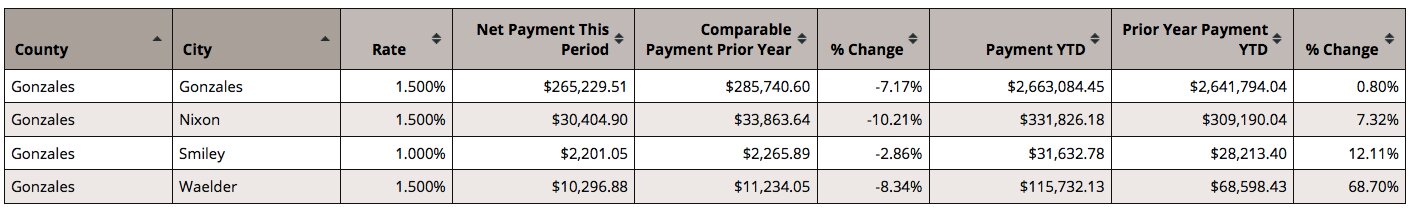

Sales tax allocations for Gonzales, the county seat, dropped by more than $20,000 from October 2022 to October 2023 — a decrease of more than 7 percent. Even Waelder, which had been seeing significant increases in its sales tax collections, experienced a cooling off in October with a decrease of 8.34 percent from the prior year.

Texas Comptroller Glenn Hegar announced he will send cities, counties, transit systems and special purpose districts $1.1 billion in local sales tax allocations for October, 4.5 percent more than in October 2022.

These allocations are based on sales made in August by businesses that report tax monthly.

For the month of October 2023, Gonzales County municipalities received a combined $308,132.34 in sales tax allocations, down some $25,331.84 or just under 7.6 percent below the $333,464.18 received during October 2022.

For the year, county municipalities have received $3,142,275.54, up $94,479.63 or 3.1 percent, above the $3,047,795.91 received through the first ten months of 2022.

Sales tax allocations for Gonzales, the largest city in the county which generates the lion’s share of sales tax revenue, were $265,229.51, down $20,511.09 or 7.17 percent below the $285,740.60 received during October 2022.

For the year, the city has received $2,663,084.45, up $21,290.41 or 0.80 percent, above the $2,641,794.04 received at this same point in 2022.

Waelder received a total of $10,296.88, down 8.34 percent or $937.17, below the $11,234.05 received in October 2022. For the year, Waelder has received $115,732.13, up $47,133.70, or 68.7 percent, above the $68,598.43 received at this point in 2022. The city has smashed the record $84,776.57 it received in all of 2022 and still has allocations coming in November and December.

Sales tax receipts for Nixon were $30,404.90, down $3,458.74, or 10.21 percent, below the $33,863.64 received in October 2022. For the year, the city has received $331,826.18, up $22,636.14, or 7.32 percent, above the $309,190.04 received at this same point last year.

Finally, Smiley’s sales tax receipts were $2,201.05, down $64.84, or 2.86 percent, from the $2,265.89 received in October 2022. For the year, the city has received $31,632.78, up $3,419.38 or 12.11 percent above the $28,213.40 received in the first ten months of 2022.

Three cities in Gonzales County — Gonzales, Nixon and Waelder — collect a 1.5 percent sales tax rate, while Smiley collects a 1 percent sales tax.

Comments