Sales tax allocations drop for sixth time in seventh months

Inflation concerns may be causing people to spend less than before

For the sixth time in seventh months, Gonzales County’s municipalities received less in combined sales tax allocations than they did the same month in the previous year — a trend which bears watching as the year continues and cities start to prepare for their next fiscal budget.

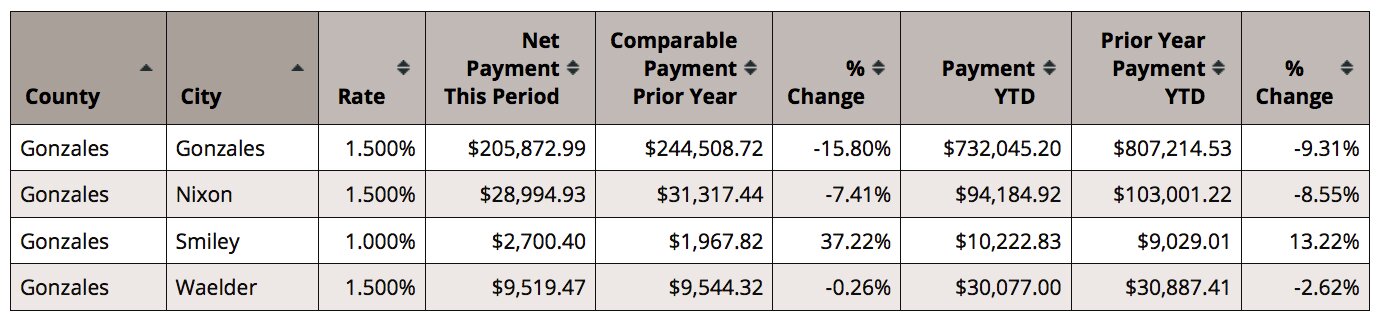

Combined sales tax allocations for the month of March 2024 for all four municipalities was $247,087.79 — down $40,250.51 or 14 percent from the $287,338.30 that was received in March 2023. That combined amount was just barely over the $244,508.72 that Gonzales received by itself last March.

And it’s not just Gonzales County that is feeling the pinch. Texas Comptroller Glenn Hegar announced he sent cities, counties, transit systems and special purpose districts $980.9 million in local sales tax allocations for March, 2.2 percent less than in March 2023.

These allocations are based on sales made in January by businesses that report tax monthly.

For the year, Gonzales County municipalities have received a combined total of $866,529.95, down $83,602.22 or 8.8 percent from the $950,132.17 received as of this point last year.

Sales tax allocations for March 2024 for Gonzales, the largest city in the county which generates the lion’s share of sales tax revenue, were just $205,872, down 15.8 percent or $38,635.73 from the $244,508.72 the city received last March.

It marked the worst March allocation for the city since March 2021, when the city received just $186,048.48, and the worst month overall since October 2021, when the city only received $199,162.74. For comparison, in March 2020, which is for sales from the January just before shutdowns caused by COVID-19, the city received $236,744.15.

For the year, the city has received $732,04.520, down 9.31 percent or $75,169.33 from the $807,214.53 Gonzales had received at this point in 2023.

“We are certainly paying attention to the sales tax,” City Manager Tim Crow said. “We have been trending downward this year and we are only about halfway through at this point. We can’t predict the future economic outlook for the city, but it seems like with higher inflation, people are holding onto as much of their money for as long as possible.”

Crow noted the COVID-19 pandemic created a reduction in sales tax about three years ago but people had started to spend money again, which had led to an increase in sales tax allocations in the past several years.

“I really believe that an increase in inflation has created some uncertainty for spending,” Crow said. “It is concerning and something we are monitoring, but we don’t feel like we are in a crisis right now. We will certainly pay attention to it and do what we can to make sure we stay within the confines of our budget.”

Waelder received a total of $9,519.47, down just $24.85 or 0.26 percent from the $9,544.32 received in March 2023. For the year, Waelder has received a total of $30,077, or just $810.41 less than the $30,887.41 the city had received through this time last year.

Sales tax receipts for Nixon were $28,994.93, down 7.41 percent or $2,322.51 from the $31,317.44 received in March 2023. For the year, the city has received $94,184.92, 8.55 percent or $8,816.30 less than the $103,001.22 received through this time last year.

Finally, Smiley’s sales tax receipts were $2,700.40, an increase of 37.22 percent or $732.58 more than the $1,967.82 received in March 2023. For the year, Smiley is the only city in the black, having received $10,222.83, or 13.22 percent more than the $9,029.01 received through the first three months of 2023.

Three cities in Gonzales County — Gonzales, Nixon and Waelder — collect a 1.5 percent sales tax rate, while Smiley collects a 1 percent sales tax.

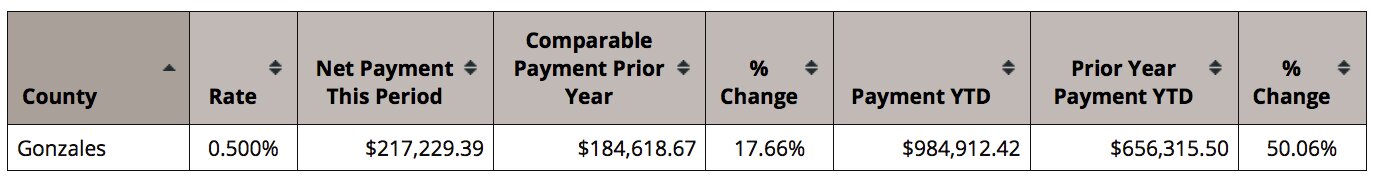

Gonzales County itself also receives a 0.5 percent sales and use tax and for the month of March 2024, the county received $217,229.39, 17.66 percent or $32,610.72 more than the $184,618.67 received in March 2023. For the year, the county has received $984,912.42, 50.06 percent more than the $656,315.50 received through this point last year.

Comments