Gonzales County municipalities start off 2024 with higher sales tax allocations

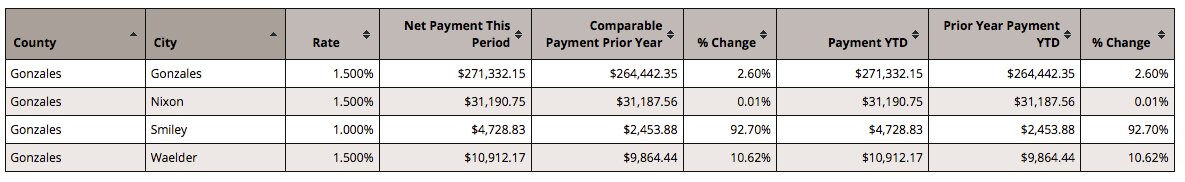

The year 2024 began on a positive note for all four Gonzales County municipalities as they all saw increases in local sales tax allocations over what they received in January 2023, according to information released by Texas Comptroller Glenn Hegar.

January 2024 sales tax allocations were up $10,215.67 above those received in January 2023 and $16,223,40 above what those citie received in December 2023, ending a string of four straight months of sales tax receipt decreases when compared to the same period in the previous year.

Hegar announced he sent cities, counties, transit systems and special purpose districts $1.1 billion in local sales tax allocations for January, 3.3 percent more than in January 2023. These allocations are based on sales made in November by businesses that report tax monthly.

For the month of December 2023, Gonzales County municipalities received a combined $318,163.90 in sales tax allocations, up nearly 3.32 percent above the $307,948.23 received during January 2023. It was also more than the $301,940.50 in sales tax allocations received in December 2023.

Sales tax allocations for Gonzales, the largest city in the county which generates the lion’s share of sales tax revenue, were $271,332.15, up 2.60 percent or $6,889.80, above the $264,442.35 the city received in January 2023. It was also $12,237.39 more than the $259,094.76 received in December 2023. It is the 12th highest monthly total ever for the city of Gonzales and the most money Gonzales has ever seen in a January sales tax allocation, eclipsing the previous best set in 2023.

Waelder received a total of $10,912.17, up 10.62 percent, or $1,047.73, over the $9,864.44 received in January 2023. This is the city’s ninth-best month of all time and a new record for the month of January, marking the first time sales tax allocations for that month have ever exceeded $10,000. The previous record was set last January. It is worth noting the amount received by Waelder was lower than the $11,658.65 received in December 2023.

Sales tax receipts for Nixon were $31,190.75, up just 0.01 percent, or $3.19, above the $31,187.56 received in January 2023. However, the amount is $2,343.10 better than the $28,847.65 the city received for December 2023.

Finally, Smiley’s sales tax receipts were $4,728.83, up 92.70 percent, or $2,274.95, above the $2,453.88 the city received in January 2023 and up $2,489.39 above the $2,239.44 received in December 2023. It is the second-best January ever for Smiley and best since January 2019.

Three cities in Gonzales County — Gonzales, Nixon and Waelder — collect a 1.5 percent sales tax rate, while Smiley collects a 1 percent sales tax.

Gonzales County itself also receives a 0.5 percent sales and use tax and for the month of January 2024, the county received $210,053.34, up 6.89 percent, or $13,556.16, above the $196,497.18 received by the county in January 2023.

Comments