GISD CFO talks taxes regarding upcoming bond issue

With the Gonzales ISD $95.08 million bond election less than a month away, the district has been working hard to keep the community informed, especially regarding taxes.

One of the big concerns from the community is how will the bond election impact residents’ taxes if either proposition passes.

BACKGROUND

Prop A: If approved, will fund the building of a Career & Techical Education Building and new Ag Barn at the potential new high school site in the near future, renovations, safety, accessibility, and security of GISD campuses and buildings.

Prop B: 7,000 seat artificial turf lighted Stadium, 8 lane track, concessions, partial locker rooms, restrooms, parking, scoreboard, field events, Baseball/Softball artificial turf, lighted, bleachers concession, 8 lighted tennis courts, weight room.

GISD Chief Financial Officer Amanda Smith has been speaking with residents during the community bond meetings the district has been hosting in several locations.

“We've been very fortunate to have what I'm calling a roadshow trying to educate and inform as many voters as possible. We can't of course the law requires that we not advocate for or against anything. So our primary goal has been to just make sure people have accurate current information so they can make an informed decision,” Smith said.

Homestead Exemption

One of the big questions from the bond meeting was the homestead exemption, and the definition of the that: “Homestead exemptions remove part of your home's value from taxation, so they lower your taxes.”

Smith said the residence homestead exemption is for a “primary residence” in Gonzales. She added for the district under the current law there is a $40,000 homestead exemption.

“So what that means is for a $100,000 home, $40,000 would be subtracted from that value before the tax rate is applied to calculate your tax bill. So you would actually only pay taxes on $60,000 instead of $100,000,” Smith said.

GISD posted the form from the Texas Comptroller onto their bond website under homestead (https://www.gonzalesisd.net/Page/4816).

Also eligible for the homestead exemption are residents who are 65 or older, and residents that are disabled.

Smith said there’s a tax ceiling for school district taxes for residents who are 65 or older.

“Once you reach 65 years of age, your homestead, your primary residence, hits the maximum school district taxes you will ever pay. So it’s a ceiling, it's not an exemption, it's truly a ceiling. Your tax bill cannot go any higher,” Smith said.

Smith added the ceiling can go down if the property value decreases.

Tax Rate

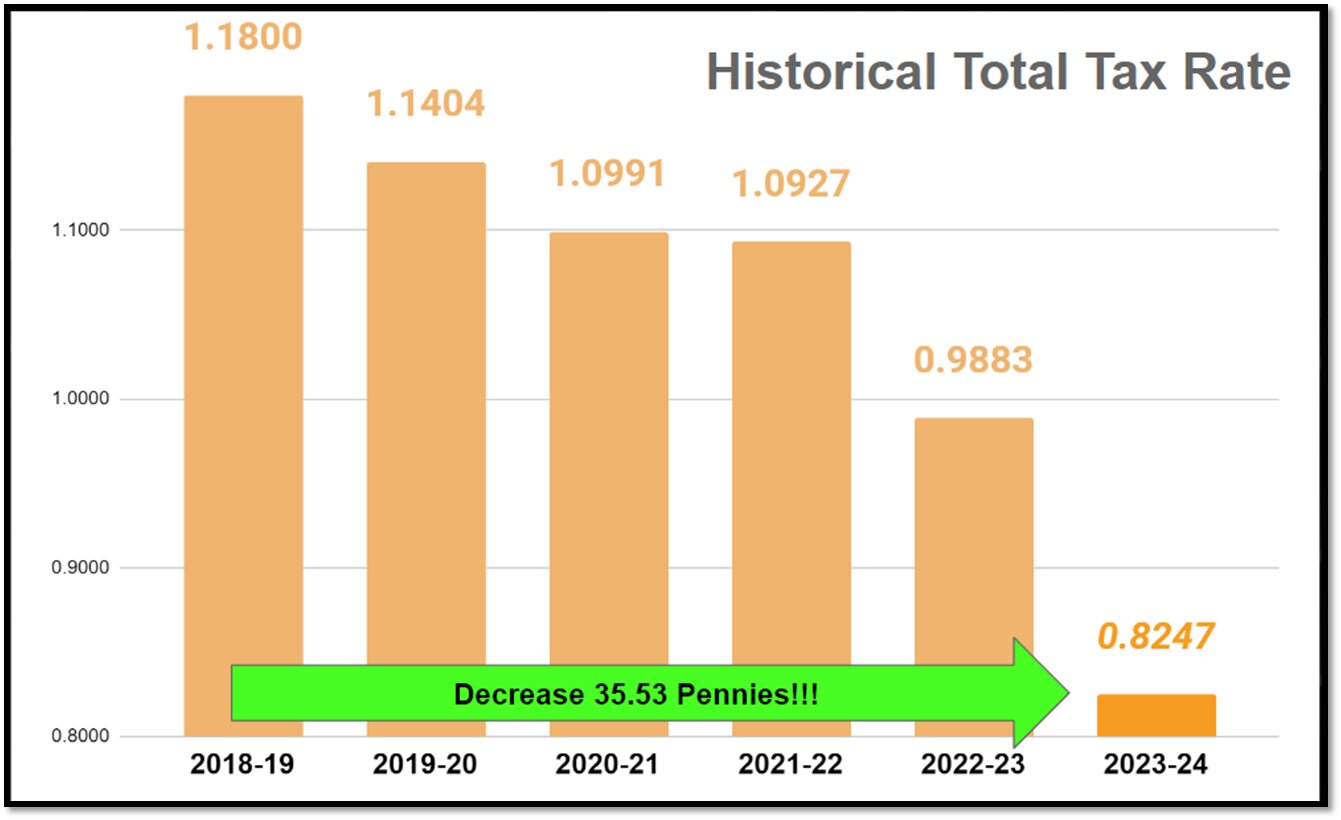

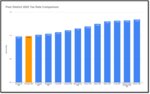

The school district’s tax rate has gone down again this year; the project tax rate for 2023-24 is 0.8247 and since 2018, the tax rate has dropped 35.53 pennies.

With the Texas Legislature passing Senate Bill 2 (SB2), it mandates that school districts to compress their tax rates for Maintenance and Operations (M&O), according to Smith.

“Our property values grew over 25 percent. And we were mandated to decrease our M&O tax rate. And that is anticipated to continue into future years. So we decreased our tax rate 16.36 pennies [from last year’s tax rate], I mean, so and we're estimating if both propositions pass, that the tax rate will be increased 15.27 pennies.”

Smith went over the tax rate increases from both propositions; Prop A: 8.13 pennies, Prop B: 7.14 pennies, and if both passed it’ll combined to 15.27 pennies.

“It is possible that one proposition passes if one does not. And the two propositions are two propositions and not one because Texas law requires that any athletic facility that has a seating capacity of more than 1,000 people be a standalone proposition on our ballot.” Smith said.

Election Day

The city will not only vote on two propositions in November; they’ll have another proposition to vote to increase the homestead exemption from $40,000 to $100,000.

“So if you have that $100,000 property that I mentioned earlier, right now, that $100,000 property is only taxed at $60,000. But if that $100,000 homestead exemption becomes law, they will be zero.” Smith said.

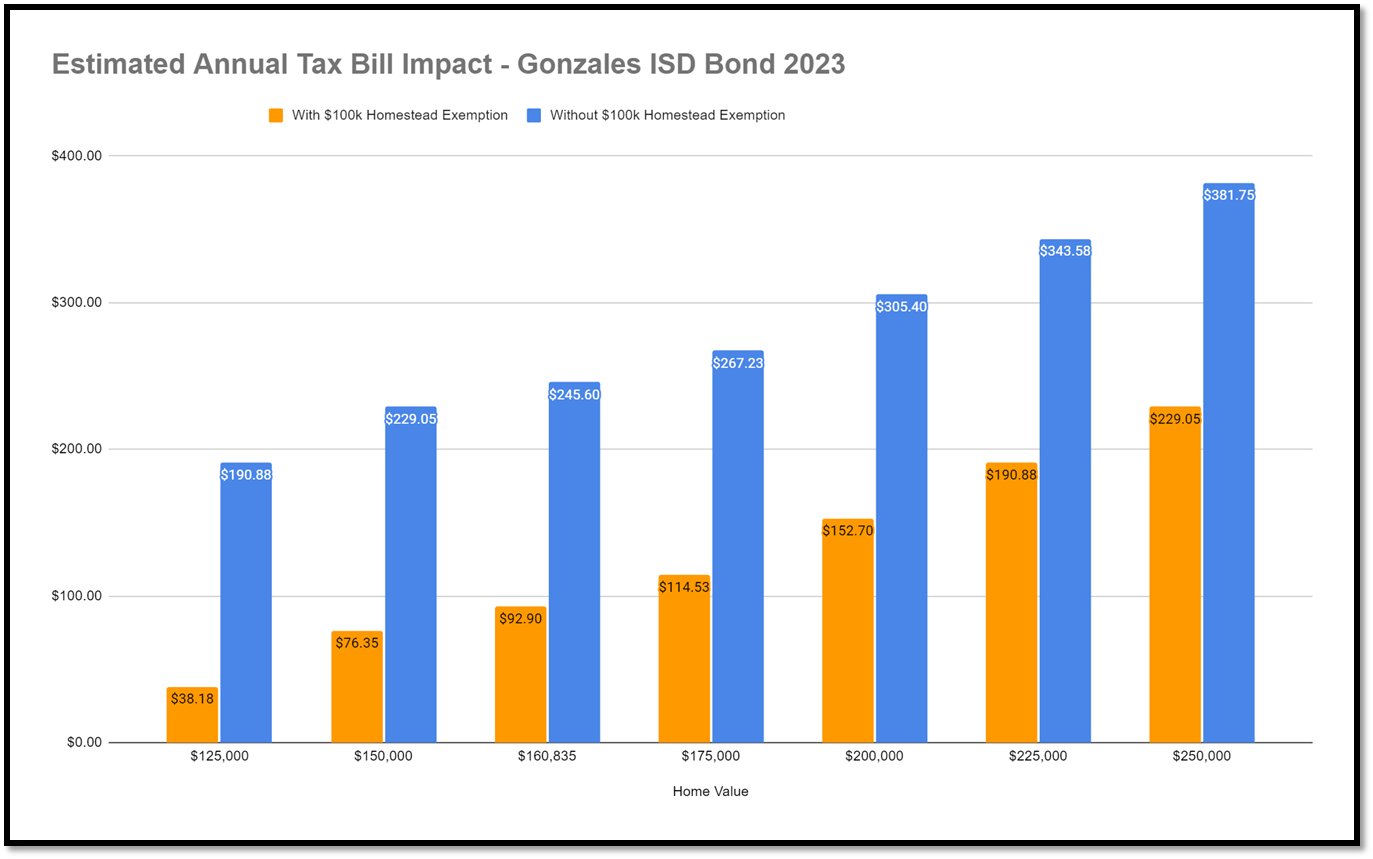

Smith used a $175,000 home value as an example; with the $100,000 homestead exemption it’ll cost $114.53 a year ($9.54 a month) and without the $100,000 exemption, it’ll cost $267.23 a year for residents.

“Although the district tax rate would increase with the successful bond election, a property owner’s home value with this increased exemption may decrease enough that it may offset whatever increase the district has in its tax rate,” Smith said.

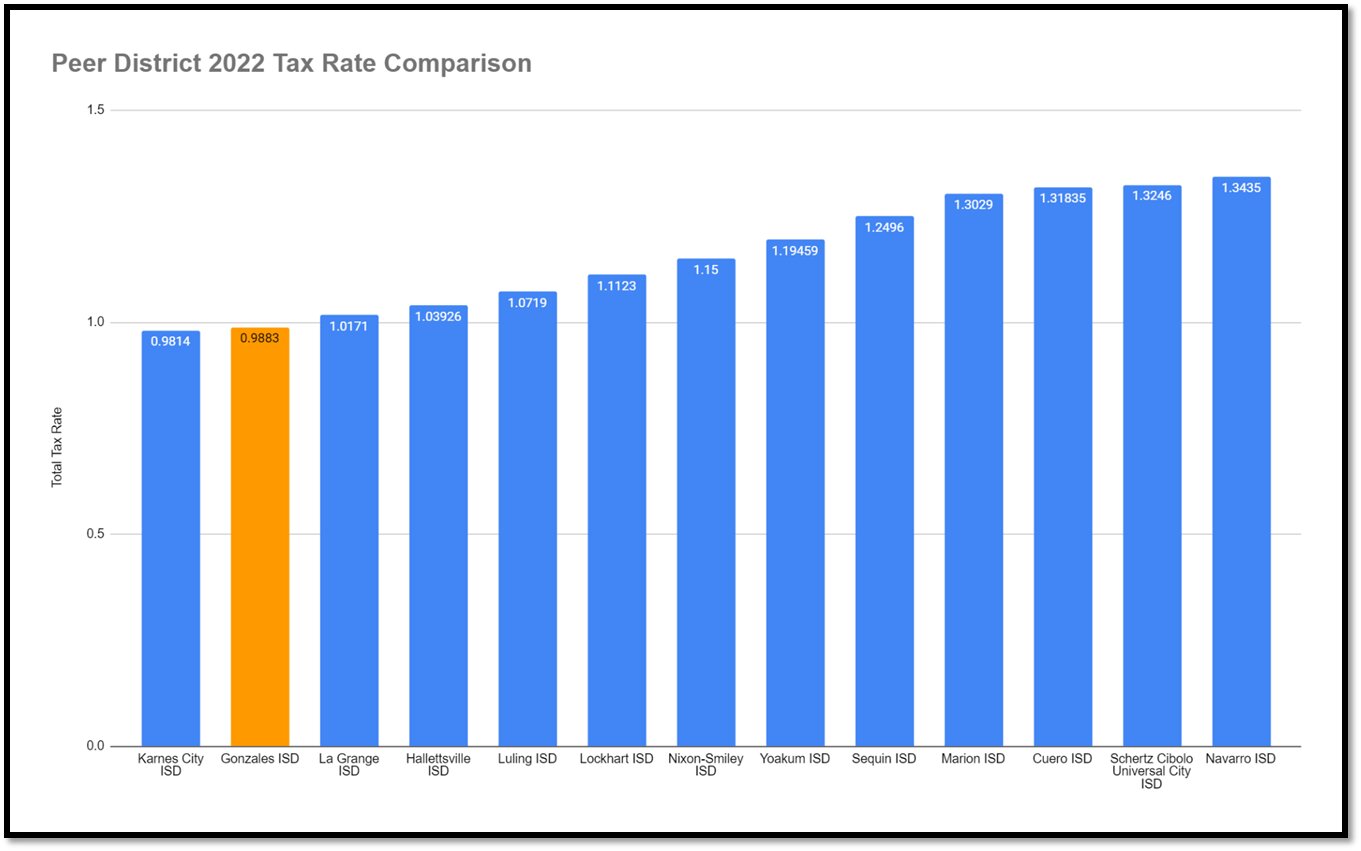

Compared to other school districts in the surrounding areas since 2022, GISD has the second lowest tax rate with 0.9883 (Karnes City is the lowest at 0.9814); Nixon-Smiley ISD has a 1.15 tax rate and Cuero ISD 1.31835 tax rate.

PROJECTS COST

One of the biggest questions asked at the Victoria College bond meeting Monday. Sept. 18 was project budgets; and Smith said the numbers may be different due to the current economy, market and inflation.

“We're trying to do a really good job of making sure that we can deliver if these are success,” Smith said.

PROP A:

--CTE Building: $12.5 million project budget, $3.5 million soft costs, $1.6 million escalation, and $2.4 million contingency (TOTAL: $20 million)

--Ag Barn: $1.625 million project budget, $455,000 soft costs, $208,000 escalation, and $312,000 contingency (TOTAL: $2.6 million)

--District Wide Safety & Security, Accessibility, Maintenance Project: $20 million project budget, $2.4 million soft costs, $2.240 million escalation, and $3.360 million contingency (TOTAL: $28 million)

PROP B:

--Athletic Complex: $27.8 million project budget, $7.784 million soft costs, $3,558,400 escalation, and $5,337,600 contingency (TOTAL: $44,480,000)

“There were a few people in the audience that wanted to know what the project budget was, versus contingency escalation. And then soft costs are like our architect and engineering that we have to pay.” Smith said.

The bond election is set for Tuesday, Nov. 7 and Smith hopes the community will educate themselves before the election begins.

“I'm a parent of students in our school system. I'm a property owner, lifelong resident. And I just hope that people make an informed vote that we as a community, do our best to vote with our heads. You know, emotion weighs in so much of dealing with money and children especially,” Smith said

“And it is very important, but I just hope that people take the time to educate themselves and make an informed decision. Either way [vote for or against] because these are the community schools. Dr. A [Dr. Elmer Avellaneda, GISD superintendent] has that right when when he said that,” Smith concluded.

Editor's Note: There was an error in the story which made print in which a decimal was left out of $3.5 million in soft costs for the CTE building. The Inquirer regrets the error.

Comments